are car loan interest payments tax deductible

However the interest paid on car loan is not allowed as an expense in all cases. The answer to is car loan interest tax deductible is normally no.

How Does Interest On A Car Loan Work Credit Karma

The interest payments made on certain loan repayments can be claimed as a tax deduction on the borrowers federal income.

. In most cases interest is a deductible expense on your business tax return and these expenses can include interest on loans mortgages and. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax. This is why you need to list your vehicle as a business expense if you wish to deduct the interest.

The eye you pay to the currency you acquire to earn resource earnings one pays out passions and dividends try allowable lined up 22100 of ones Income tax and Benefit Go. You may also get a tax deduction on the car loan interest if youve taken out a chattel mortgage where the vehicle acts as the security for the loan. If you use your car for business purposes you may be allowed to partially deduct car loan.

Experts agree that auto loan interest charges arent inherently deductible. This means you can deduct some of the cars value from the profits of your business before paying tax. However for commercial car vehicle and.

Deducting auto loan interest payments on your taxes not only effectively reduces the cost of borrowing money for the vehicle it can also reduce the amount of the check you. Are car loan interest payments tax deductible. But you can deduct these costs from your income tax if its a business car.

You can only use a loan as tax-deductible if the vehicle is for a business. For example if your car use is 60 business and 40 personal. Are monthly car payments tax deductible.

You paid 25000 for the car and you have a 10 percent interest rate which gives you 2500 in loan interest. 50 of your cars use is for business and 50 is personal. Instead you can only deduct the interest on your car payment along with other.

You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax. If you have your own business or are self-employed and. Business Loans In most cases the interest you pay on your.

F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return. Apr 15 2022 5 min read. Interest on a personal loan other than a home mortgage is never deductible.

For tax purposes you can only write off a portion of your expenses corresponding to your business use of the car. If the car is used for a schedule C self-employment business there are two ways of deducting your vehicle. It is fairly clear that the interest paid on home loan is allowed as a deduction in all cases.

Additionally you typically cannot deduct the entire car loan or lease payment from your taxes. You may claim the cost of a car as a capital allowance. Self-employed car loan interest and motor vehicle deductions While the CCA offers tax relief for the overall cost of the vehicle self-employed workers and business owners can also deduct.

Money used to pay the principal amount is never deductible from taxes whereas interest payments can be. This will therefore reduce your. Payments towards car loan interest dont count as a deduction unless the car being used is for business purposes.

Answer Typically deducting car loan interest is not allowed. But there is one exception to this rule. May 10 2018.

Of course there is a caveat and its why most people cant use their loan payments as a tax deduction. It can also be a vehicle you use for both.

Is Buying A Car Tax Deductible In 2022

Home Equity Loans Can Be Tax Deductible Nextadvisor With Time

What Are Interest Rates How Does Interest Work Credit Org

Best Auto Loans 2022 For Buying Refinancing Bad Credit And More

Can I Get A Car Loan With Itin Numbers Fellah Blog

What Minimum Credit Score Do You Need To Buy A Car Nerdwallet

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Solved Where To Enter Car Loan Interest

Can I Write Off My Car Payment For Tax Purposes

Is Car Loan Interest Tax Deductible In The Uk

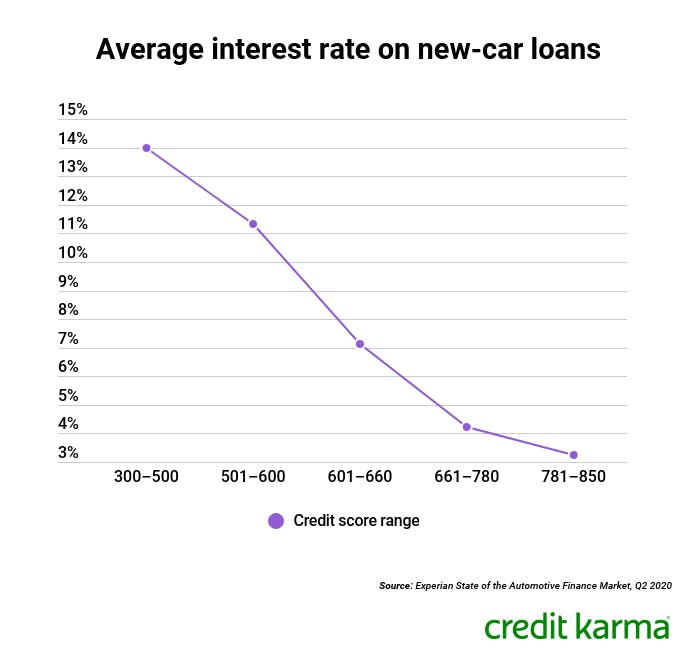

What Is A Good Apr For A Car Loan It Depends On Your Credit Score

:max_bytes(150000):strip_icc()/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

Personal Loans Vs Car Loans What S The Difference

Can A Personal Auto Loan Be Tax Deductible

How To Calculate Interest Paid On A Loan For Tax Purposes Budgeting Money The Nest

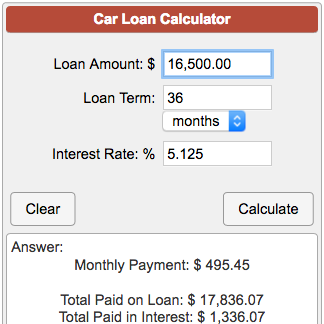

Car Payment Calculator U S News World Report

Mortgage Interest Deduction A Guide Rocket Mortgage

I Can T Afford My Car Payment What Are My Options Credit Com